The Spanish Special Tax Regime, popularly known as “Beckham’s Law”, is an optional regime whereby individuals acquiring tax residence status in Spain as a result of being assigned to work in Spanish Territory may opt to be taxed under the Spanish Non-Resident Income Tax Law even if they are considered as tax residents in Spain.

Requirements for the Special Tax Regime application

- The individual must not have been a resident of Spain for tax purposes in the 10 tax periods prior to their assignment.

- The assignment to Spain is the result of an employment contract (either a local contract or through a letter of assignment), or the result of acquiring the status of administrator of a company, provided certain requirements are met.

- Income may not be obtained through a permanent establishment located in Spanish territory.

Deadline for the application of the Regime

The period for requesting the application of this Special Tax Regime is 6 months following the date on which the individual registers with the Spanish Social Security Authorities (or the date of start of the assignment on the Social Security certificate of coverage from the home country).

General information about Spanish Special Tax Regime

The application of the Special Tax Regime is requested by filing Form 149 (“Modelo 149. IRPF. Régimen especial aplicable a los trabajadores desplazados a territorio español”) and submitting certain documentation attesting to compliance with the established requirements.

The taxpayer may be taxed under the Special Tax Regime during the year in which she or he become Tax Resident in Spain and the following five years.

Taxation under the Spanish Special Tax Regime

Taxation under this regime implies that all employment income obtained by the worker during the period of application of the Special Tax Regime is considered obtained in Spanish territory.

Notwithstanding, all employment income derived from an activity performed prior to the transfer to Spanish territory won’t be understood to be obtained during the application of the Special Tax Regime.

Finally, this Special Tax Regime allows the application of a tax credit up to the maximum limit of 30% for the employment income obtained abroad.

Deadline for the submission of the annual tax return

The annual tax return is filed via Form 151 before 30 June following the calendar year when the income was earned.

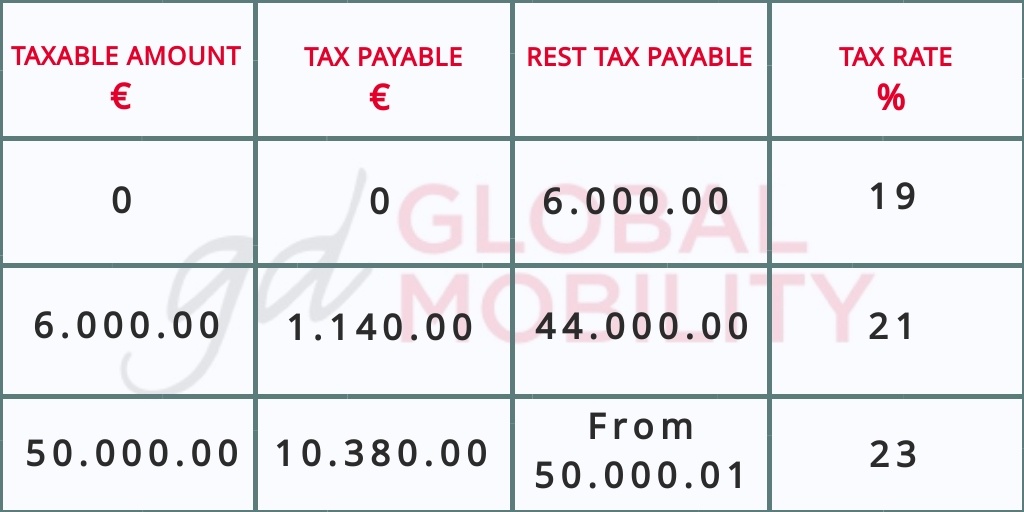

Tax rates of Spanish Special Tax Regime

It will be subject to the tax rates stated below, without being able to apply any deductions or reductions on the taxable income (except donations):

- Tax rate for employment income: 24% tax rate if it does not exceed 600.000€ (45% for the amounts exceeding this figure):

- Income proceeded from Dividends, Interest and Capital Gains from the transfer of assets (savings tax base):

Other benefits about Spanish Special Tax Regime

- Individuals taxed under the Special Tax Regime in Spain shall be subject to Wealth Tax as Non-Residents, this is, only on their net assets located in Spanish Territory.

- Under the Spanish Tax Law, there is an obligation for taxpayers to inform the Tax Administration of accounts, shares, assets, properties, and rights over properties located abroad with the Form 720. However, individuals who are Tax Residents in Spain but taxed under the Special Tax Regime won´t be required to submit this form.

We recommend a specific and detailed study of each case with respect to applying for the Spanish Special Tax Regime for impatriates. GD Global Mobility can advise you on the tax benefits that you can apply to income obtained in Spain. Get in touch with us and resolve all your doubts about tax management services in Spain.