First of all, it is important to clarify that the regime of a posted worker is temporary and will depend on the country of destination and the bilateral double taxation agreement that has been signed with that country.

International taxation is made up of two fundamental pillars:

- Administrative tax obligations that must be met by both the company and the posted workers.

- International tax planning and optimization: broadly speaking, this second aspect is made up of the tools that make it possible for a posted worker to have a higher net salary and/or for the company to have a lower gross cost.

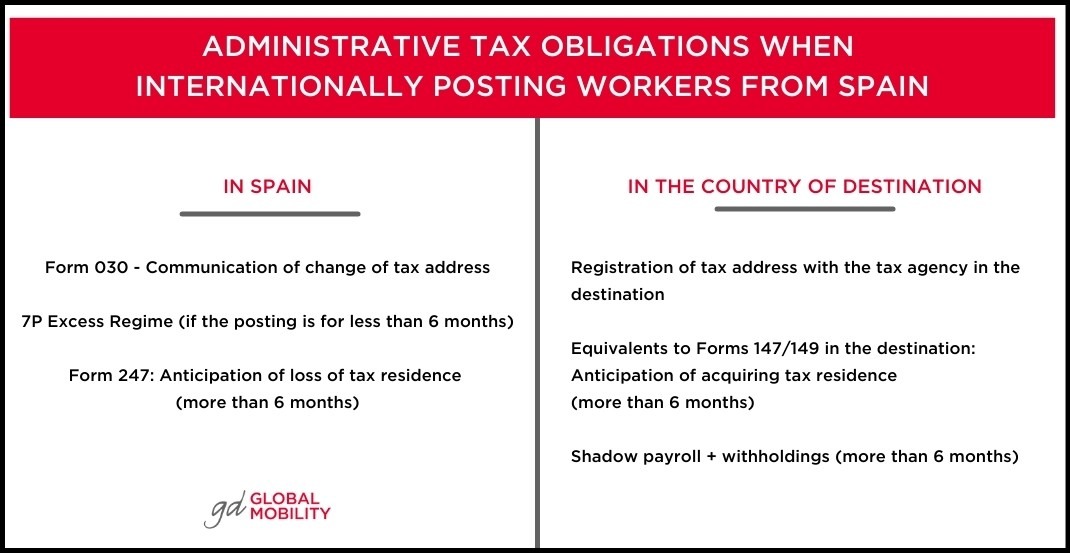

Regarding the administrative obligations in terms of tax, it is necessary to differentiate between those that must be fulfilled in Spain and those that must be fulfilled in the country of destination.

Posting of workers: tax obligations in Spain

- In Spain, the first thing that needs to be done is notify the Tax Agency of the change of the worker's tax address (through Form 030) in order to be correctly registered with the corresponding tax authority. In turn, it is advisable to apply for a Certificate of Tax Residence for the years of the posting in order to be clear about the end date.

- In case of applying for the exemption for work abroad (Article 7.P of the Personal Income Tax Law) or the excess regime, there is an administrative obligation to keep all supporting documentation that proves these conditions (for example, the Boarding Pass).

- If it is possible to foresee in advance that the worker will lose tax residence in Spain (for example, due to being abroad for more than 6 months during the calendar year), we recommend submitting Form 247 to anticipate their new tax residence and not make any Spanish personal income tax withholdings on the payslip, so that it is not necessary to wait 6 months to regularize the withholdings. In other words, Form 247 is intended to eliminate the withholding in Spain on the payslip of the posted worker before the foreseeable acquisition of the status of tax resident in the destination. As detailed in Article 32 of the TRLIRNR: “Employees who, not being taxpayers of this tax (IRNR), are going to acquire said condition as a result of their posting abroad may notify the Tax Administration, leaving evidence of the date of departure from Spanish territory, for the sole purpose that the payer of income from work considers them as taxpayers of this tax.”

Determining the status of resident or non-resident in each country is one of the key aspects to take into account when establishing the tax obligations of the company and the employees in each territory, since this condition will mark whether the worker pays IRPF or IRNR. In addition, to be able to carry out good planning and tax optimization for a posting, it is necessary to determine beforehand both:

- the residence and;

- the obligations of the posted worker.

Here you can find more information about how to prove tax residence in Spain.

With GD Global Mobility you can rest easy. We take care of the management of your taxes. Get in touch with us and resolve all your doubts about tax management services in Spain.

Posting of workers: tax obligations in the destination country

- Registration of the tax address with the Tax Agency of destination.

- In the case of anticipating the acquisition of tax residence in the destination, and if the tax legislation of the country of destination allows it, apply for the recognition of the status of tax resident (the equivalent of our Forms 147 or 149) so as not to have to regularize it later.

- Shadow payroll: if the employer is required to make deductions and/or contributions in the destination, a “shadow payroll” must be calculated. The shadow payroll is advisable in case the worker continues to receive Spanish payslips during the posting to facilitate the fulfillment of labor, tax, and social security obligations in the destination country. In this way, the management/regularization of the payment of taxes and withholdings is facilitated.